I'm an economist working at the intersection of market design and the digital economy. Combining recent econometric, AI & machine learning techniques for causal inference with economic theory and structural econometrics, I study how to design platforms and build trust in markets. I hold a PhD in Economics from Paris School of Economics and University Paris 1 Panthéon-Sorbonne, a Master in Economics from Paris School of Economics and EHESS, and a B.A. in Philosophy & Economics from University of Bayreuth. I was very fortunate to be advised by Olivier Tercieux and Liam Wren-Lewis. In spring 2024, I visited Yeon-Koo Che at the Economics department of Columbia University.

Email PSE profile

Julius Goedde

PhD in Economics, Paris School of Economics

Job Market Paper

Pricing in markets without money: Theory and evidence from home exchanges

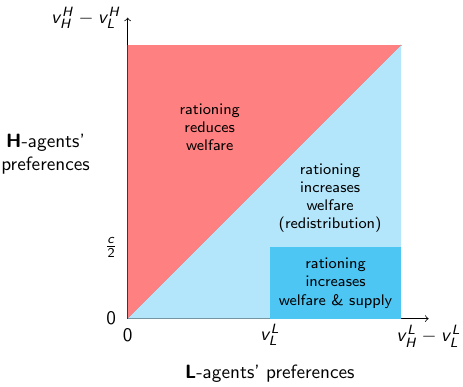

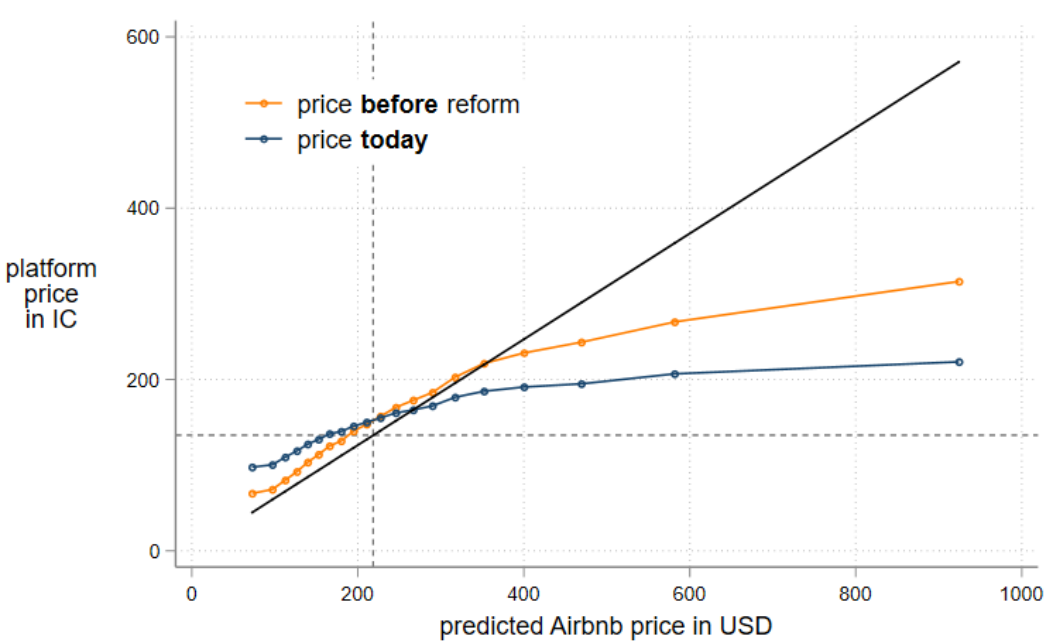

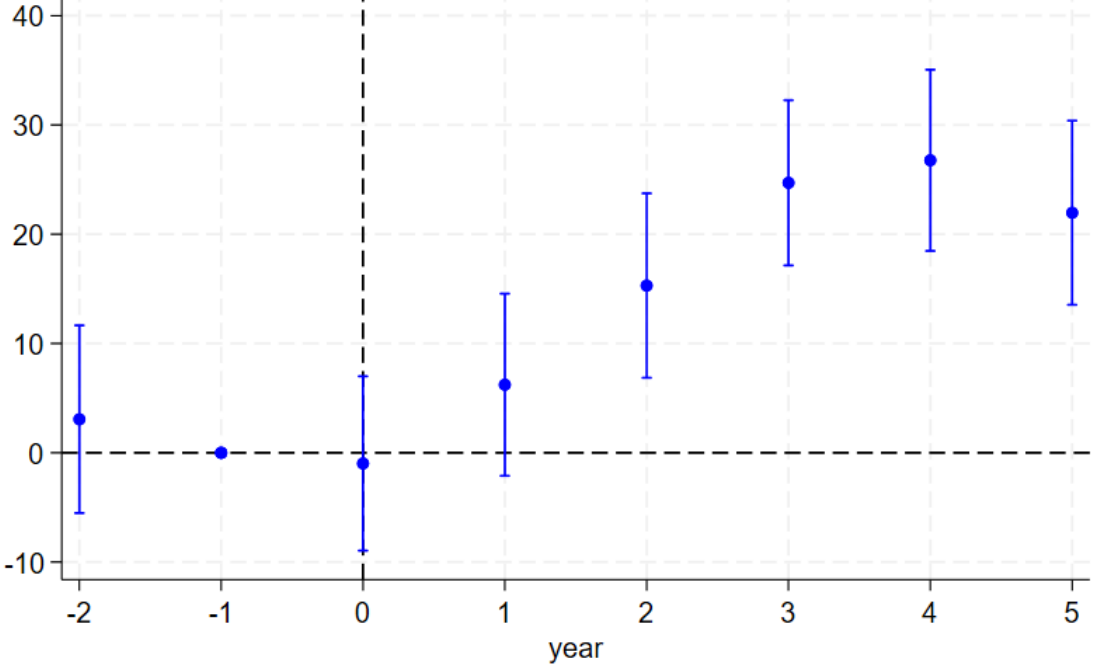

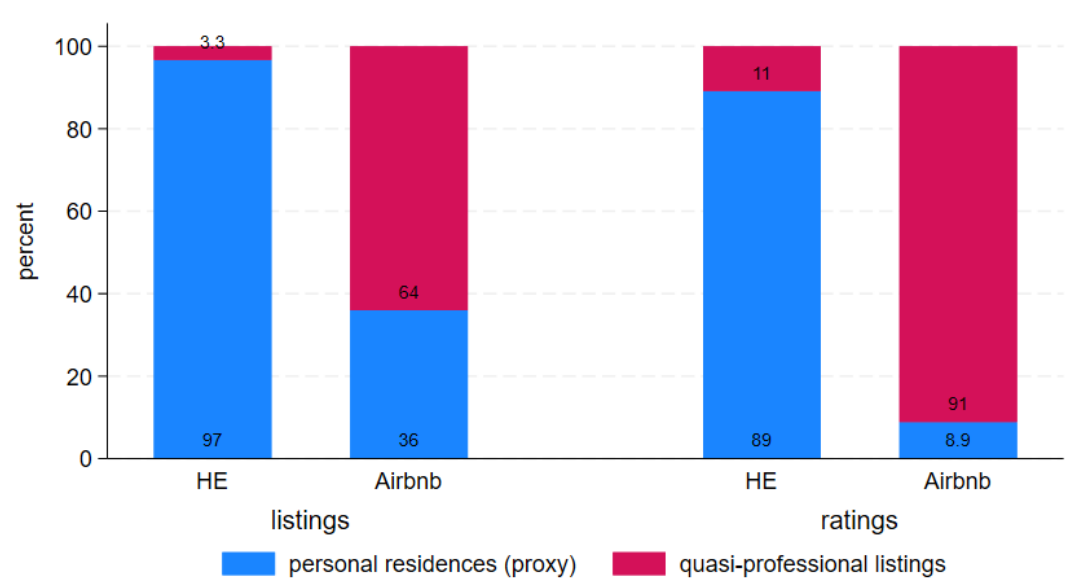

Abstract: A growing number of markets use token money instead of real money to allocate resources, such as class seats, food donations or holiday homes. Agents earn token money by supplying and can only spend tokens by consuming within the system. A platform decides how to set goods’ token prices. Should it i) clear the market, as assumed in canonical competitive equilibrium frameworks, or ii) compress prices and ration excess demand? I characterize in a two-type, two-period model under which preference structures compressing prices increases supply and utilitarian welfare. Intuitively, this is possible when income effects are strong, and participation effects are weak. I confirm the models’ predictions on a large home exchange platform, combining proprietary data on the universe of transactions with several natural experiments. I show empirically that income effects are large and that a reform that reduced the price of attractive homes increased their supply and did not reduce their participation. I confirm that many users have a strong preference against for-money platforms, allowing the exchange platform to set non-market-clearing prices. Broader insights are that lessons from traditional markets may not easily extend to token economies and that market designs without real money can have advantages even in settings where money is common.

Work in Progress

"Misplaced trust? Preferences for similarity in an online market", with

Gabrielle Fack and

Liam Wren-Lewis.

Draft

Abstract: This paper analyzes the extent to which individuals prefer to exchange with similar people in a market where trust is important. Using unique data from a digital platform for holiday accommodation, we find that suppliers prefer to trade with guests who share similar characteristics. Indeed, when deciding who to trade with, on average, they place more weight on similarity than on guests’ prior ratings. However, analyzing measures of suppliers' post-exchange satisfaction, we find that similarity matters much less than these prior ratings. Suppliers therefore appear to make systematic mistakes by prioritizing similarity over measures of past guest behavior.

"Dynamic Matching in a Token Economy: An Empirical Model of Peer-to-Peer Platforms", with

Sam Altmann and

Liam Wren-Lewis.

Abstract: We develop a structural model of an exchange economy where agents trade indivisible goods (homes) with token-money. Building on Menzel (2015), we identify preferences assuming a stable matching in a large market. We estimate the model using transaction and request data from a large platform for exchanging homes. Observing rejected requests allows us to separately identify preferences of both sides. We quantify the welfare and equity effects of different pricing schemes, the initial token endowment of new users and of using a currency system instead of facilitating only two-way exchanges.

"Changing seats: Two-sided markets in the presence of switches", with Xavier Lambin and Jérôme Pouyet.

Abstract: While traditional two-sided market theory assumes that consumers are locked into one side of the market, we argue that in some cases, consumers may switch sides while staying within the same platform. We examine the strategic implications for platforms and their competitors. We test and calibrate the model using proprietary data from a global ride-sharing platform.

Papers Accepted to Peer-Reviewed Conferences

"Pricing in Markets without Money" (short version). Abstract in MATCH-UP 2024

Seminars and Conferences

| 2025 |

|

| 2024 |

|

| 2023 |

|

| 2022 |

|

Grants, Awards and Scholarships

| 2025 | Prize for Best Paper, 8th Doctoral Workshop on the Economics of Digitization (TSE) |

| 2024 | Honoroable mention for "Best Student Paper" of the 18th North American Meeting of the Urban Economics Association (UEA) |

| 2024 | Selected for the "Rising Star" session of the European Association for Research in Industrial Economics (EARIE) |

| 2024 | ANR-funded research grant "Why (not) to use money in the sharing economy" (4,000 EUR) |

| 2024 | Selected for the "Rising Star" session of the International Industrial Organization Conference (IIOC) |

| 2023 | Doctoral mobility grant by Paris School of Economics |

| 2023 | Doctoral mobility grant by the Columbia Alliance to visit Columbia University |

| 2020 - 2023 | 3-year PhD funding by l'École Doctorale Économie Panthéon-Sorbonne and Paris School of Economics |

| 2018 - 2020 | Scholarship by the German Economy Foundation (sdw) |

| 2018 - 2020 | Graduate scholarship by the German Academic Exchange Service (DAAD) |